aurora sales tax rate

Christopher Minick the citys chief financial officer told members of the Finance Committee that Stolp Island Social would bring in about 70000 in. Gas and electric services.

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10.

. Aurora 8B10B is a scalable lightweight link-layer protocol for high-speed serial communication. 1000am - 830pm. Aurora is a LogiCORE IP designed to enable easy implementation of Xilinx transceivers while providing a light-weight user interface on top of which designers can build a serial link.

Rachel and Magnum Faust from Tulsa and their son Kaden faust 8 shop for gifts at Target at 21st and Yale Avenue in Tulsa Okla on. Colorado has 560 special sales tax jurisdictions with local sales taxes in. Gaming PCs.

Select the Illinois city from the list of popular cities below to see its current sales tax rate. Aurora sales tax applies to the retail sale or rental of all tangible personal property. Minnesota has state sales tax of 6875 and allows local governments to collect a local option sales tax of up to 15There are a total of 274 local tax jurisdictions across the state collecting an average local tax of 0521.

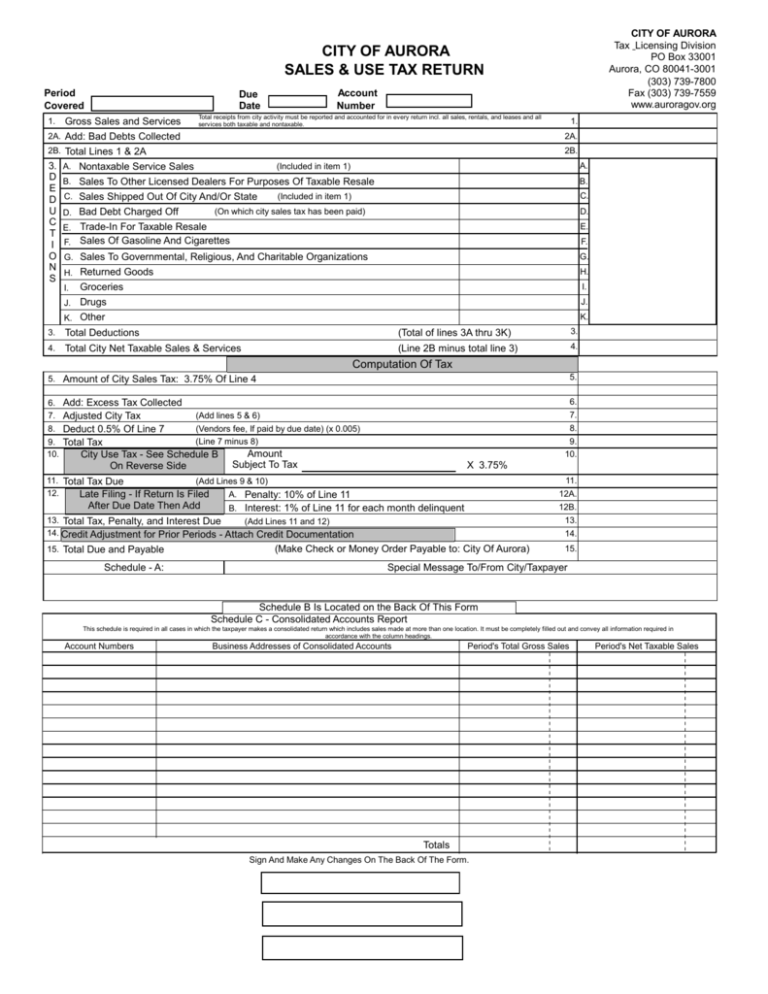

Sales Tax General Information. Groceries and prescription drugs are exempt from the Colorado sales tax. If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40.

1175 N 205TH ST SHORELINE WA 98133-3206. 1000am - 830pm. Fourteen states including Colorado allow local governments to collect an income tax.

Combined with the state sales tax the highest sales tax rate in Minnesota is 8875 in the. With local taxes the total sales tax rate is between 6250 and 11000. Use them as a mechanism for funding infrastructure.

1 study session that included Brian Matise a lawyer with experience litigating metro district issues and a director on the governing board of Tollgate Crossing Metropolitan District No. Use the Use Tax Rate List below to get the rate for the location where the merchandise was delivered stored used or consumed. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts.

Gaming PCs. The protocol specification is open and available upon request. It also applies to the retail sale of certain services that are listed below.

Miftah announces withdrawal of fixed tax of Rs3000 on small traders with electricity consumption of less than 150 units per month. Click here for a larger sales tax map or here for a sales tax table. Colorado has recent rate changes Fri Jan 01 2021.

All sales will be made at the price posted on the pumps at each Costco location at the time of purchase. All sales will be made at the price posted on the pumps at each Costco location at the time of purchase. 0645 Aurora Redmond.

Illinois has recent rate changes Wed Jul 01 2020. Cigarettes in South Dakota are taxed at a rate of 153 per pack of 20 slightly lower than the national mark. Shop Costcos Aurora CO location for electronics groceries small appliances and more.

Click here for a larger sales tax map or here for a sales tax table. Auroras council discussed the pros and cons of such districts in Aurora during an Aug. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities.

What is a local income tax. South Dakota Alcohol Tax. Along with the sales tax rates described above some cities in the state levy an additional 1 tax on alcohol sales bringing the total rate up to 75 in many cities.

While the federal income tax and the Colorado income tax are progressive income taxes with multiple tax brackets all local income taxes are. Select the Colorado city from the list of popular cities below to see its current sales tax rate. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 279 local tax jurisdictions across the state collecting an average local tax of 409.

South Dakota Cigarette Tax. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return.

With local taxes the total sales tax rate is between 2900 and 11200.

How Colorado Taxes Work Auto Dealers Dealr Tax

U S Property Taxes Comparing Residential And Commercial Rates Across States

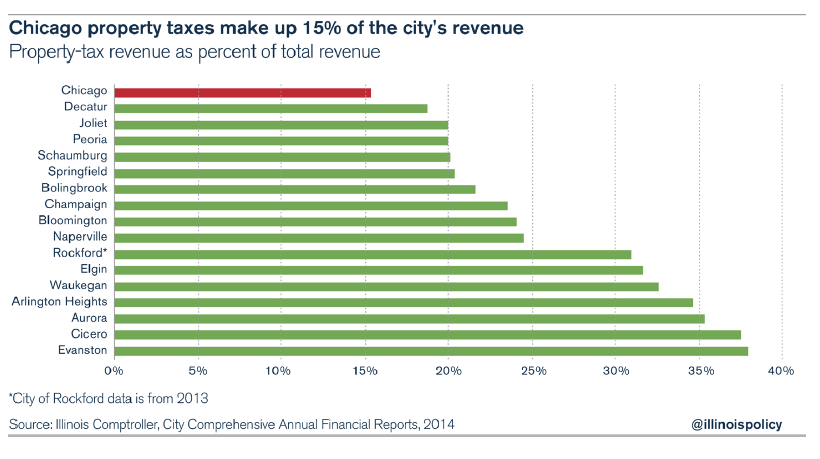

Chicago Sales Tax Hotsell 54 Off Www Ingeniovirtual Com

Nebraska Sales Tax Rates By City County 2022

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Aurora Kane County Illinois Sales Tax Rate

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

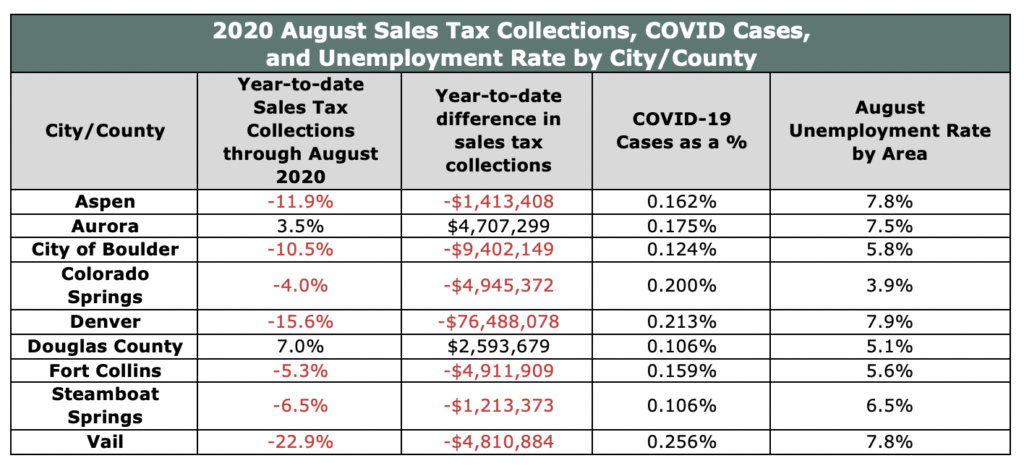

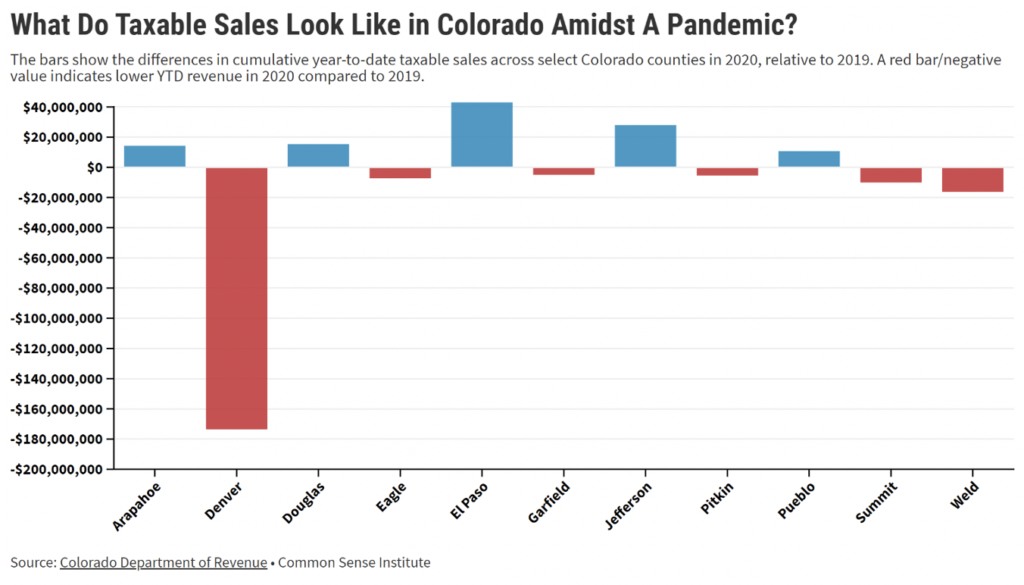

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Sales Tax Rates By City County 2022

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

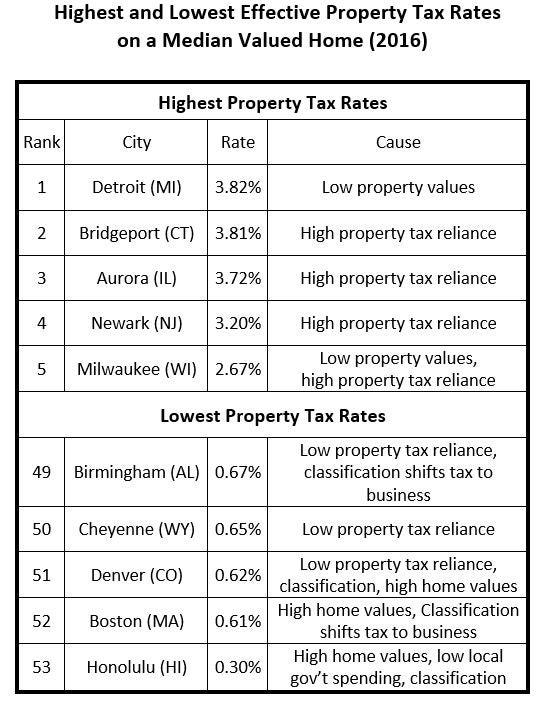

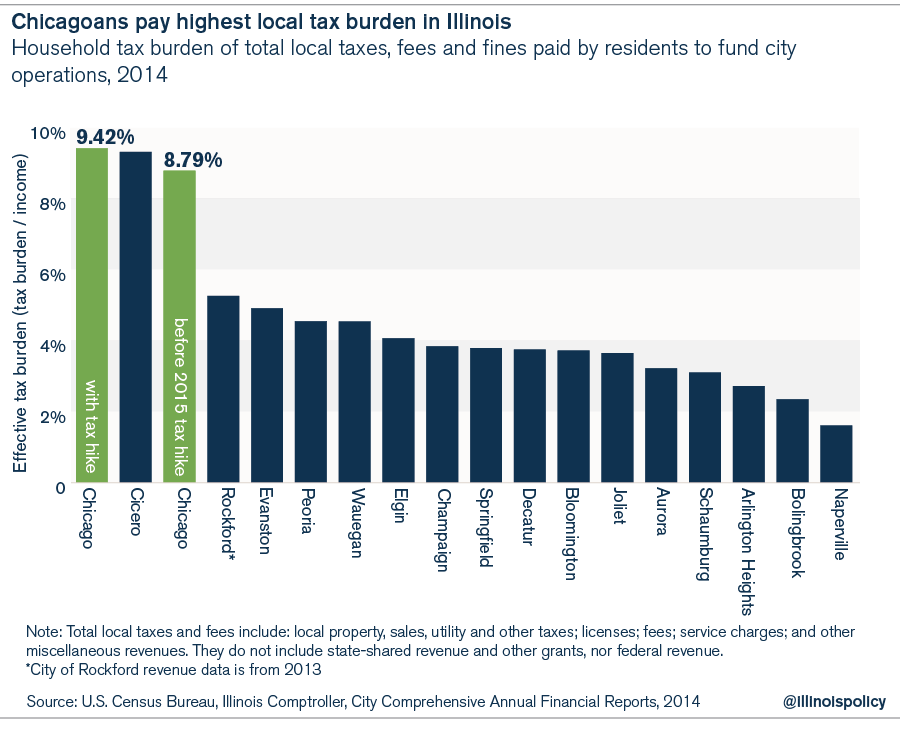

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute