fsa health care limit 2022

Double check your employers policies. The internal revenue service irs has announced an increase in the flexible spending account fsa contribution limits for the health care flexible spending account hcfsa and the limited.

Hsa Vs Fsa What S The Difference Quick Reference Chart

You dont pay taxes on this money.

. The health FSA contribution limit is established annually and adjusted for inflation. Get a free demo. Dependent Care Fsa Limit 2022 Hce.

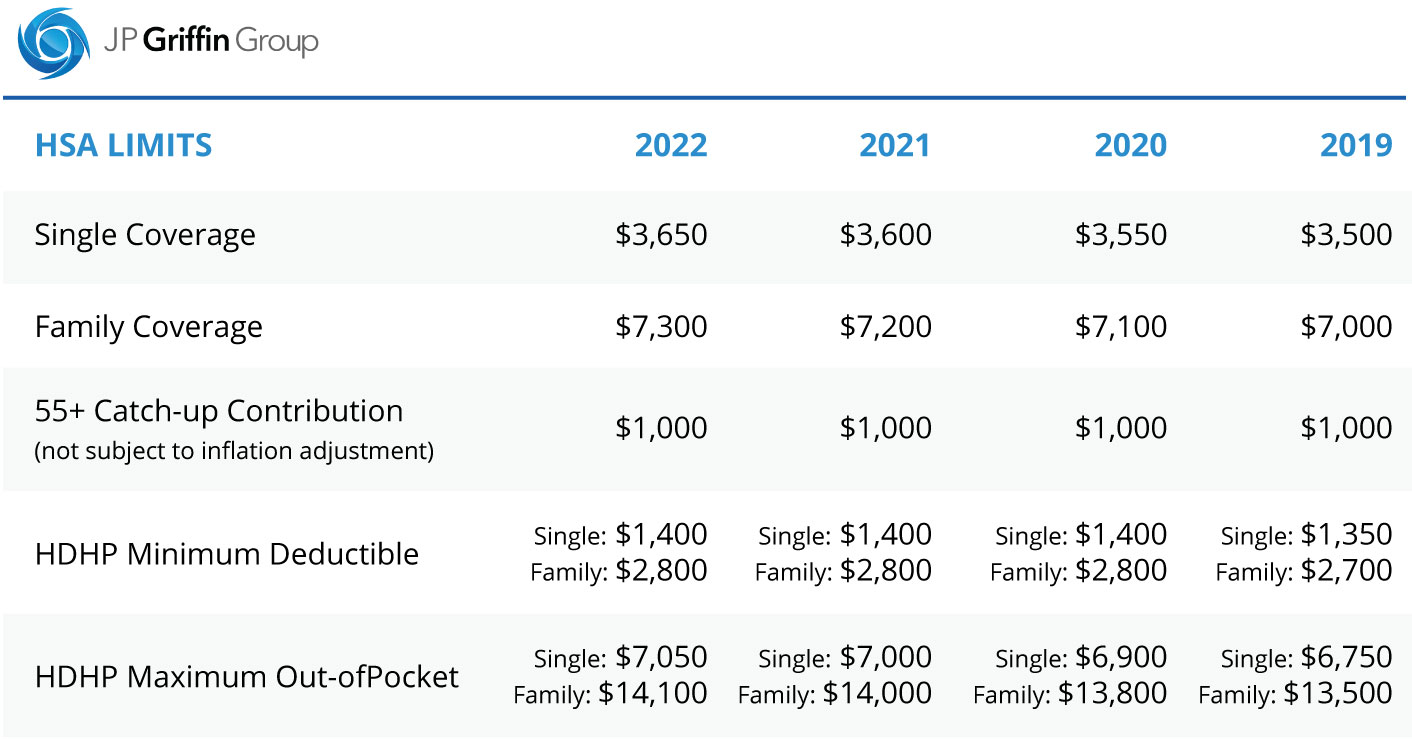

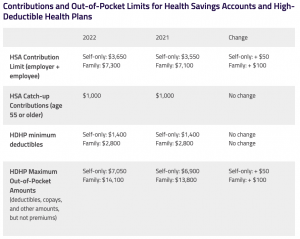

Learn more from GoodRx about the increase in FSA contribution. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA.

The health fsa contribution limit is established annually and adjusted for inflation. For the 2021 income year it is 2750 26 USC. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

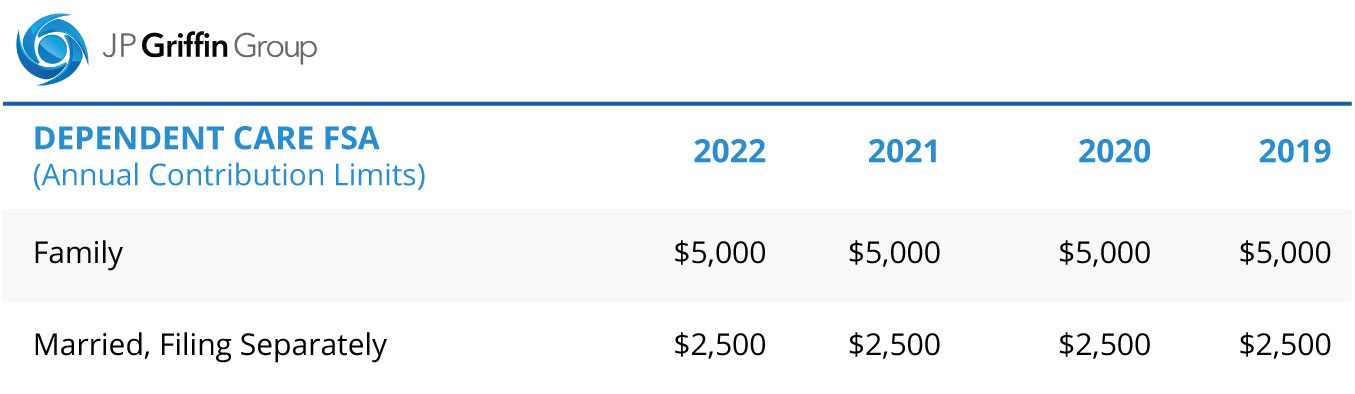

Dependent Care Fsa Limit 2022 Irs. Employees can elect up to the IRS limit and still receive the employer contribution in addition. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately.

6 rows 2022 Health FSA Contribution Cap Rises to 2850 SHRM Online November 2021. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. Dependent care fsa limit 2022.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. A120 sahid nagar bhubaneswar pin. 2022 New Jersey High Cost Limits Last Updated.

3 rows the chart below shows the adjustment in health fsa contribution limits for 2022. And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is. As a result the IRS has revised contribution limits for 2022.

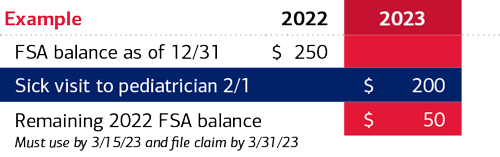

For the 2021 income year it is 2750 26 usc. Back to main content. If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over into the 2023 plan year does not affect the maximum limit that employees can contribute.

If you have a dependent care FSA pay special attention to the limit change. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. Employees in 2022 can put up to 2850 into their health care flexible.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. The limit on annual employee contributions toward health FSAs for 2022 is 2850 up from 2750 in 2021 with. And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022. BestPlaces data for child care expenses is the annual cost of child care for both home-based care and at larger child care centers.

Easy implementation and comprehensive employee education available 247. FSAs only have one limit for individual and family health plan participation but. The Health Care standard or limited FSA rollover.

125i IRS Revenue Procedure 2020-45. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. Bergen County NJ 07026 2022 FHA Loan Limits.

If you provide health care fsa employer contributions this amount is in addition to the amount that employees can elect. The Health Care standard or limited FSA annual maximum plan contribution limit will increase from 2750 to 2850 for plan years beginning on or after January 1 2022. Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and qualified transportation fringe benefits will increase slightly for 2022.

IRS annual contribution limit for 2022. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and. Qualified transportation and health FSA limits.

The limit is expected to go back to 5000. Federal Housing Administration FHA Loans are federally insured mortgages. For the 2021 income year it is 2750 26 usc.

For 2022 the maximum amount that can be contributed to a dependent care account is 5000. Arpa Automatically Sunsets The Increased Dependent. Sun January 2 2022.

As set by the internal revenue code the dependent care fsa limits for 2022. In 2021 the dependent care fsa limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. The American Rescue Plan Act and IRS Notice 2021-26 allowed employers to increase the limit of.

Step 2 Enroll to Start Saving. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Change Loan Limit Type.

Dependent Care Fsa Limit 2022 Income Limit. Elevate your health benefits. This is an increase of 100 from the 2021 contribution limits.

The contribution limit is 2850 up from 2750 in 2021. The IRS has officially announced under Revenue Procedure 2020-45 the 2022 Flexible Spending Account FSA and Commuter limits. After deciding how much to contribute to your account.

The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year. Figure represents the average of costs for annual care of an infant and a 4-year-old. Limits for qualified transportation fringe benefits and health FSAs are expected to rise significantly in 2023 thanks to the dramatic increase in C-CPI-U for the year an eye-popping 70 for the 10 months ending June 2022.

In urban areas the cost is for care at a child care center and for home care in rural areas. Ad Custom benefits solutions for your business needs.

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Flexible Spending Account Contribution Limits For 2022 Goodrx

Cares Act A Big Win For Women S Health And Menstrual Care

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

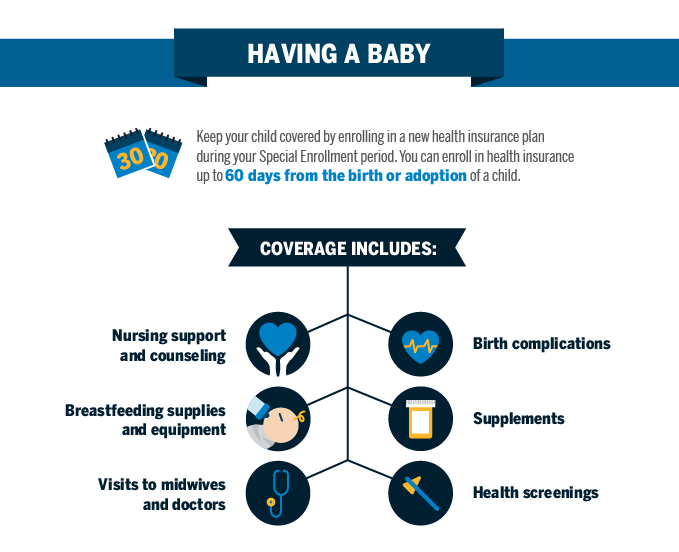

Qualifying Event Baby Blue Cross And Blue Shield Of Texas

What The New 2022 Hsa Limits Mean For You The Difference Card

Health Care Consumerism Hsas And Hras

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Flexible Spending Account Contribution Limits For 2022 Goodrx

High Deductible Health Plan Hdhp Pros And Cons

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Health Care Spending Account Office Of Employee Relations

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Account Contribution Limits For 2022 Goodrx

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

Understanding The Year End Spending Rules For Your Health Account