dc vs va income tax calculator

The Virginia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Virginia State Income Tax Rates and Thresholds in 2022. Of course all of these taxes have.

Virginia Income Tax Calculator Smartasset

The District has an average effective property tax rate of 056.

. 6 on taxable income between 10001 and 40000. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Enter your salary into the calculator above to find out how taxes in Washington DC USA affect your income.

Years ago DC used to have higher income tax rates than VA but as youve pointed out its pretty similar now after the last few years of reforms. Capital gains from the sale of a home for example in Virginia are taxed as regular income which means they will likely face the top rate of 575. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

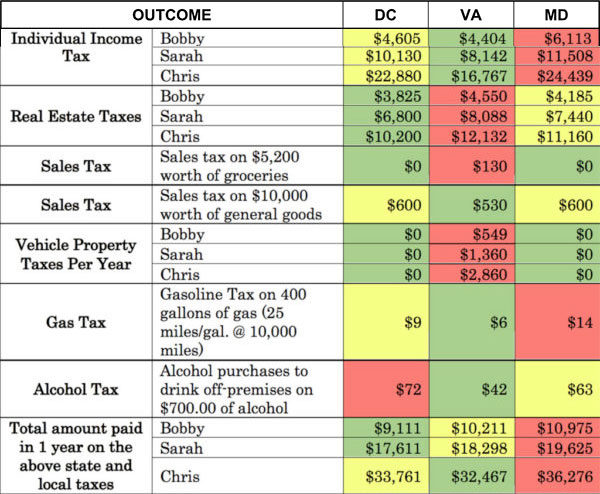

These include a district income tax with rates ranging from 4 to 895 a 6 sales tax and property taxes on real estate. Here are some of the most crucial differences in the ways that the three states will tax your income. There are lots of things to consider.

Receive only wage or salary income in Virginia. When you live in DC you will likely go outeat out more often. For more information about the income tax in these states visit the Virginia and District Of Columbia income tax pages.

The District of Columbia weathered the pandemic with stable tax collections down less than 1 percent in FY 2020 while recovering above pre-pandemic levels in FY 2021. If you have a car parking fees. As of 2019 there are six income tax brackets ranging from 4 to 895.

If you are exempt from Virginia income tax complete the Form VA-4 and give it to your employer. 4 on the first 10000 of taxable income. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget.

This is mostly due to Virginias income tax cap at 575 compared to Washington DCs highest rate of 85 for the bulk of his income. After a few seconds you will be provided with a full breakdown of the tax you are paying. Taxable income over 40000 is taxed at a steep 65 tax rate the top rate of 895 is reserved for taxable income over 1000000 Heres what makes DC a mixed picture on taxes.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Virginia Capital Gains Tax. For an in-depth comparison try using our federal and state income tax calculator.

If you accept employment in a reciprocity state and meet the criteria for exemption ask your employer to withhold Virginia tax. Use our income tax calculator to find out what your take home pay will be in Virginia for the tax year. In addition to federal income taxes taxpayers in the nations capital pay local taxes to the District of Columbia.

Tax rates range from 20 575. Enter your details to estimate your salary after tax. The state excise tax on regular gas in Virginia is 2620 cents per gallon which is the 32nd-lowest in the nation.

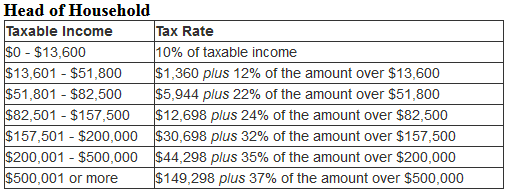

Since the top tax bracket begins at just 17000 in taxable income per. Yet even as lawmakers in eleven states have cut income taxes this year the DC. In this tax calculator you can calculate the taxes with Resident Location as Virginia and work location with all other 50 states.

With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive. For income taxes in all fifty states see the income tax by state. Washington DC Income Tax Calculator.

Details of the personal income tax rates used in the 2022 Virginia State Calculator are published below the. Of the three states Washington DC has the highest income taxes. Council has responded to.

Marylands lower standard deduction extra local income tax rates bundled with higher real estate tax rates push it past Virginia as the highest taxes of the three for each income level we analyzed. Resolving withholding errors Virginia residents. It is mainly intended for residents of the US.

Virginia State has any Reciprocity Agreement with Kentucky Maryland Pennsylvania Washington DC West Virginia states. The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

And is based on the tax brackets of 2021 and 2022. DCs Income Tax Hike Helps Maryland and Virginia Not DC. Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age.

Virginia State Payroll Taxes.

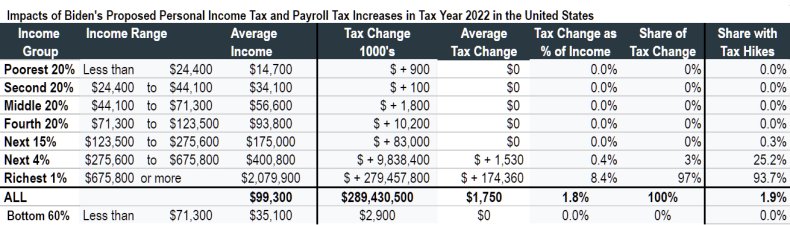

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Missouri Income Tax Rate And Brackets H R Block

Virginia Income Tax Calculator Smartasset

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Arlington Va Local News

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Delaware Taxes De State Income Tax Calculator Community Tax

Income Tax Calculator Estimate Your Refund In Seconds For Free

Get The Best Services By Tax Advisor Who Will Guide You To Avoid Surprises Losses Related To Tax At Stitley And K Small Business Tax Business Tax Tax Services

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

New Tax Law Take Home Pay Calculator For 75 000 Salary

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Llc And S Corporation Income Tax Example Tax Hack Accounting Group

Cryptocurrency Taxes What To Know For 2021 Money

A Knowledgeable Experienced Accounting Firms In Northern Virginia Our Clients Trust Us To Deliver E Mortgage Payment Calculator Accounting Services Budgeting

New Tax Law Take Home Pay Calculator For 75 000 Salary

Income Tax Calculator 2021 2022 Estimate Return Refund

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You